Liftline is in Beta, and is accepting applications for early access.

Contact us

Financial infrastructure to offer fully owned credit products.

Liftline helps you fund, build, and launch credit products with no middleman or embedded finance tax.

Products

The infrastructure layer for receivables-backed finance

Liftline sits between your invoiced revenue and lenders, transforming receivables into assets and connecting you with institutional capital.

Receivables Transformation

Turn your AR into insured, lender-ready assets

Liftline uses trade credit insurance to derisk your accounts receivable base for lender underwriting.

Capital Access

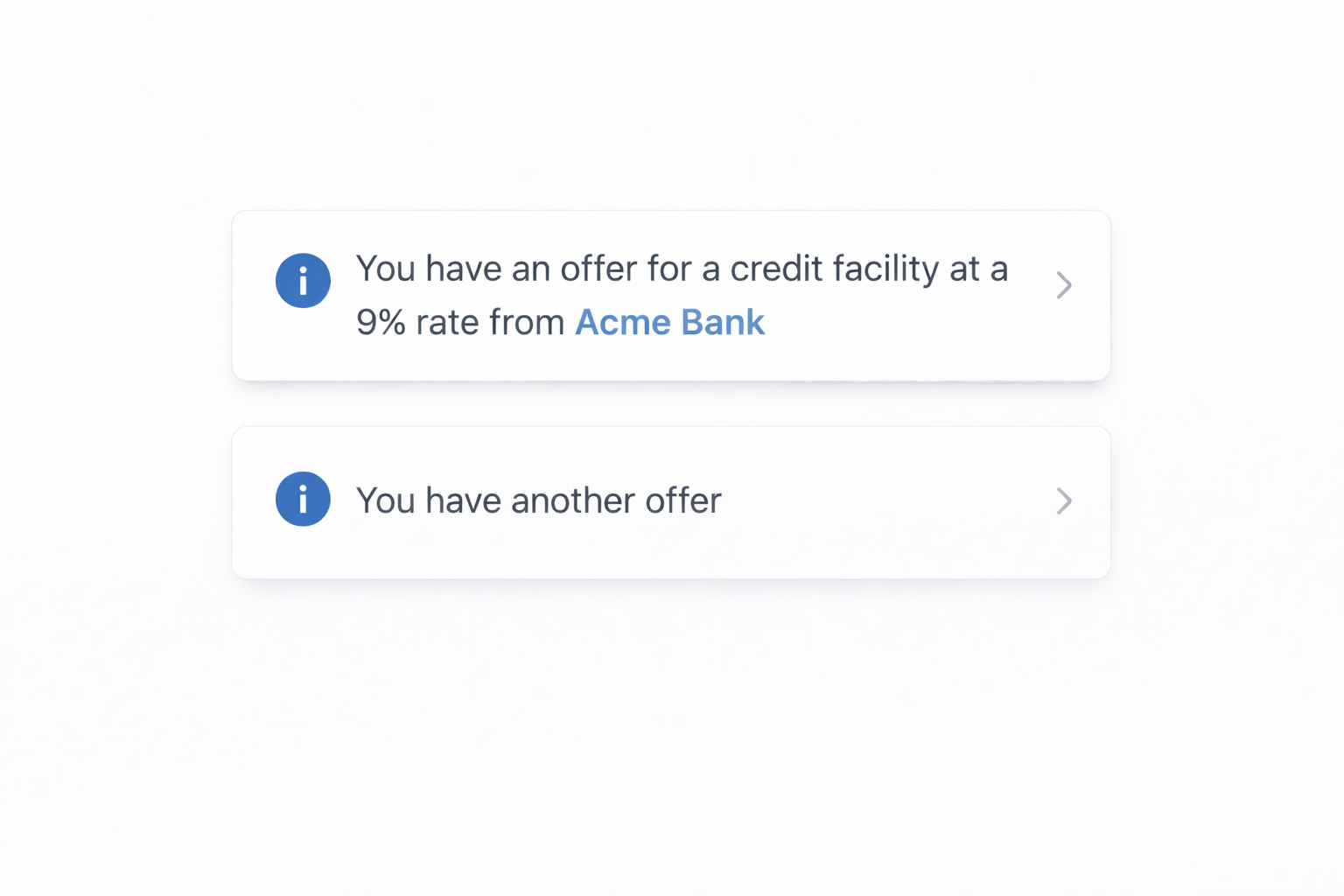

Directly connect with institutional lenders

Liftline sources terms from a curated network of lenders, enabling better pricing, larger facility sizes, and improved advance rates. You fully own the lender relationships and economics.

Structuring

Legal and account structures, built to deploy

From simple on-balance-sheet setups to off-balance-sheet SPV structures, Liftline provides pre-established legal and bank account frameworks designed to support financing without disrupting existing credit agreements.

Platform & Expertise

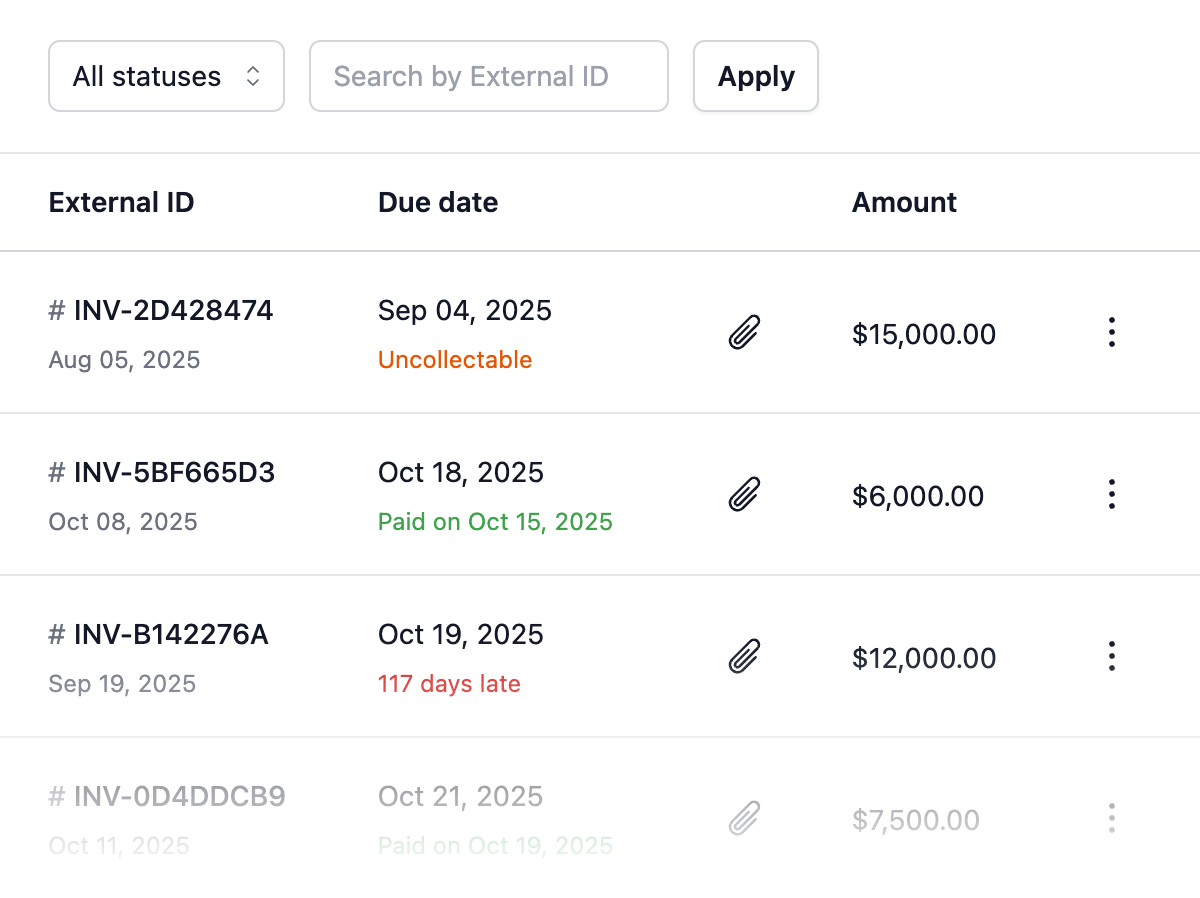

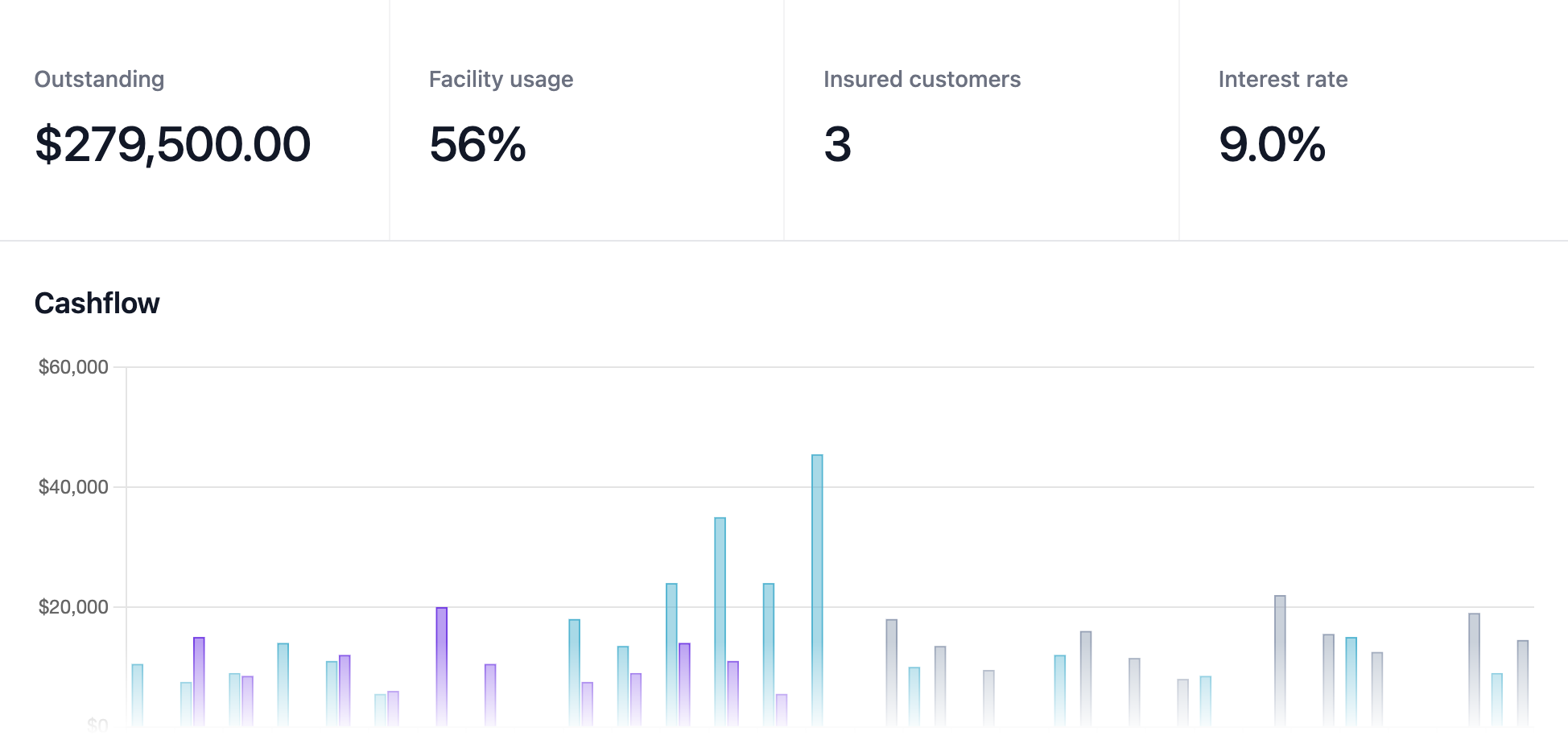

Software, APIs, and AI agents

Liftline provides a simple but powerful dashboard, API, and set of AI agents to manage eligibility, limits, performance, and lender approved reporting.

Fintech Enablement

Leverage our expertise

Liftline's team works alongside you to design, launch, and iterate on financial products, informed by experience scaling fintech offerings to billions of dollars of volume.

Solutions

Built for businesses with invoiced revenue

Liftline supports companies that sell on invoice or want to sell on invoice and those that want to offer net terms or credit products as part of their business model.

-

Companies with Invoiced Revenue at Scale

- Transform existing receivables into a revolving line of credit to support revenue-generating credit products.

-

Companies Launching Net Terms

- Offer payment terms to customers and generate payments revenue without becoming a lender.

-

Platforms & Marketplaces

- Embed financial products while owning the customer experience and economics.

-

Finance & Product Teams

- Design, launch, and manage receivables-based credit products with control and visibility.

Use Cases

Liftline enables receivables-backed financial products that align payment terms, improve cash flow, and unlock new revenue

-

Before LiftlineA two sided marketplace had 90-day payment terms from buyers but a 30-day payment obligation to suppliers. The mismatch resulted in cash flow constraints & limited growth.With LiftlineBy converting invoices into receivables-backed capital the marketplace rolled out a supplier payment acceleration product; creating a new revenue stream while improving supplier liquidity.

-

Before LiftlineA SaaS platform for subcontractors had demands to offer net terms greater than 30 days. Balance sheet constraints made this impractical, resulting in decreased usage and off-platform transactions.With LiftlineLiftline enabled the platform to offer extended net terms funded by receivables-backed capital; improving customer retention, increasing platform usage, and unlocking incremental revenue.

-

Before LiftlineCustomers wanted flexible payment options, but offering installment-based terms required underwriting credit and tying up operating cash; neither of which fit the business model.With LiftlineLiftline collaborated on the development of a B2B 'buy now pay later'-style product backed by insured receivables, allowing customers to pay over time while the platform maintained predictable cash flow.

-

Before LiftlineA company operating in an industry where net terms were standard was forced to rely on credit card acceptance due to balance sheet limitations, resulting in credit card fees with an effective APR of 36%With LiftlineBy accessing receivables-backed capital through Liftline, the company offered net terms to suppliers, eliminating excessive card fees and unlocking opportunities for monetization

Get started today

Speak with us to learn how to make capital a growth lever, not a constraint.